20 Aug 2025

MRT3 Impact Zones: Where Smart Investors Are Looking Now

The countdown to the Mass Rapid Transit 3 (MRT3) Circle Line is underway, promising a new era in Kuala Lumpur’s property market. As the city’s largest orbital transit project, MRT3 is redefining “hotspot” areas for investment and presenting unique opportunities for buyers, sellers, developers, and, notably, every forward-thinking property agent in KL.

What are the newest impact zones? Why are savvy investors pivoting their strategies? Let’s explore where the smart money is moving, how the market is changing, and how tech-driven property strategies are reshaping the landscape—for Malaysia, for 2025 and beyond.

What is MRT3? Why Does It Matter?

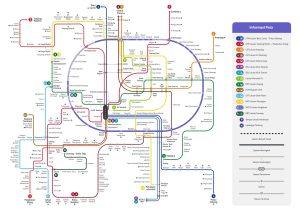

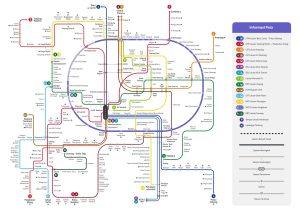

The MRT3 Circle Line is designed to complete Klang Valley’s rail network, forming a loop that unites key MRT, LRT, KTM, and monorail lines through 10 major interchange stations. The 51.6km alignment will circle from Titiwangsa, stretching through Setapak, Ampang, Cheras, Salak Selatan, Old Klang Road, Lembah Pantai, Bukit Kiara, Mont Kiara, and more. With 31 stations—some underground—it offers seamless bidirectional travel throughout the capital and into high-density residential and commercial hubs.Why It Matters:

- Properties within walking distance to new transit lines consistently see higher demand and appreciation.

- The Circle Line will integrate suburban and city centre living, reducing travel times and boosting accessibility.

- Transit-oriented developments (TODs) are attracting government incentives and private investments.

The Next Investor Hotspots: MRT3 Impact Zones

Where Are the Key Zones?

With MRT3’s alignment, investors and property agents in KL are keeping a keen eye on:- Danau Kota

- Pandan Indah

- Taman Midah

- Universiti (KL)

- Sri Hartamas

- Desa Parkcity

- Old Klang Road

- Bukit Kiara / Mont Kiara

Source: SoyaCincau

The Data-Driven Approach

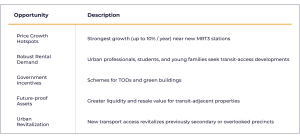

Recent market reports forecast Malaysian property price growth of 2-5% nationwide in 2025, but up to 10% annually in infrastructure-adjacent hotspots like those along MRT3. Rental yields near MRT stations are higher, and vacancy rates are dropping as demand surges.- Average House Price (2025): MYR486,678 (up 3.3% YoY)

- Rental Yields: Higher near transit

- Hot Growth Sectors: High-rise and serviced apartments in transit corridors; mixed-use developments

- Land Acquisition: MRT3’s revised plan will minimise displacement, focusing new stations where densification is feasible.

Market Analysis: What Smart Investors See

The MRT Effect

History tells us that major transport projects drive up property values. The “MRT effect” has already played out with Malaysia’s previous MRT and LRT lines—areas connected early on enjoyed sustained price appreciation and rapid urban development.Investor Advantages:

- Early entry into zones slated for new stations (before completion) means higher potential upside.

- Proximity to transit is now one of the top factors for Malaysian homebuyers and renters, especially among millennials and expatriates.

- Developers are racing to introduce new projects near planned stations, with a focus on family-friendly amenities and sustainability.

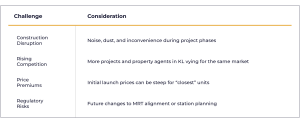

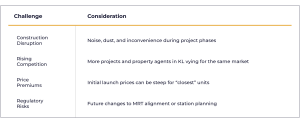

Potential Downsides:

- Short-term disruption during construction.

- Upfront price premium for units closest to stations.

- Intense competition among developers and agents is expected as more players enter the market.

Emerging Trends Powering the Market

1. Smart Technology Integration

Innovative tech is reshaping how every forward-looking property agent in KL operates:- AI-powered digital portals: Automate property matching, dynamic pricing, and virtual viewings.

- Data analytics: Predict appreciation trends by mapping MRT3 proximity and historical transit zone data.

- Smart home solutions: Residents near new lines expect integrated technology in new builds (IoT-enabled security, energy management, etc.).

2. Focus on Sustainability

MRT3-linked projects are embracing green building standards, biophilic design, and transit-oriented development (TOD) principles to satisfy regulations and modern buyers.3. Rise of Hybrid Living Spaces

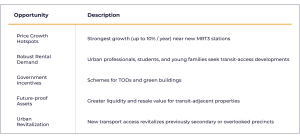

With remote and flexible work now mainstream, savvy agents and developers are marketing properties not just for commute convenience, but for integrated lifestyle features—co-working spaces, health amenities, and communal gardens.Unique Opportunities and Pitfalls

Pros for Investors

Potential Cons

Key Takeaways for Smart Investors

- MRT3 isn’t just a transportation project—it’s a generational opportunity for property value growth, urban renewal, and smart-living adoption.

- High ROI is expected in impact zones now, especially before stations are fully operational and prices normalise.

- Sustainability, tech integration, and convenience are the dominant buying triggers for 2025 and beyond.

FAQs

1. What is the completion timeline for MRT3, and when should investors act?

MRT3 land acquisition is targeted for completion by end-2026. Full operation is expected by 2030, with some phases possibly starting earlier. Early investment typically yields the best appreciation, so acting before or during construction is recommended.2. How can I identify the best MRT3 impact zones for investment?

Look for upcoming stations near established neighbourhoods, major interchange hubs, and new mixed-use developments. Consult a qualified property agent in KL who specialises in transit-adjacent opportunities.3. Will rental yields improve in MRT3 zones?

Yes, history and current trends indicate rising rental demand and yields near new transit lines, especially for small and mid-sized units attractive to professionals and small families.4. What lifestyle features are most in demand for future buyers?

Buyers now want smart home integration, communal amenities, sustainable design, and proximity to work/leisure transit stops—all increasingly prioritised in new launches.5. Are there risks in investing in property near upcoming MRT projects?

There are some risks, including construction disruption and the possibility of future regulatory or alignment changes. Due diligence and professional advice are crucial.Conclusion

The MRT3 Circle Line is poised to reshape Kuala Lumpur’s property market landscape. For the forward-thinking property agent in KL, the coming years represent unprecedented opportunities—rooted in new connectivity, changing buyer preferences, and innovation-driven market dynamics. By focusing on impact zones, leveraging technology, and anticipating sustainable growth, today’s investors and agents can capitalise on Malaysia’s next big property wave. Looking to invest? Visit gplex.com.my to discover how our team can help you navigate the property opportunities emerging along the MRT3 Circle Line.Share this article: