13 Aug 2025

Future Property Price Trends: The Impact of JB RTS, ETS & E-Art on Johor’s Real Estate Market

As Malaysia progresses well into 2025, Johor’s real estate landscape is undergoing a remarkable transformation, primarily driven by major infrastructure projects such as the Johor Bahru Rapid Transit System (JB RTS), the Electric Train Service (ETS), and the E-Art (Elevated Autonomous Rapid Transit) initiatives. These developments are not only enhancing connectivity within Johor and between Malaysia and Singapore but are also reshaping the property market dynamic, attracting local and international investors alike. In this comprehensive analysis for Malaysian homebuyers, investors, and the wider community, we examine how these infrastructure projects influence future property price trends while highlighting insights relevant to anyone seeking the best real estate agents in Kuala Lumpur to tap into broader investment strategies.

Understanding the Infrastructure Catalyst: JB RTS, ETS & E-Art

1. Johor Bahru Rapid Transit System (JB RTS):

The JB RTS is a cross-border rail link connecting Johor Bahru and Singapore, set to cut the current travel time from more than an hour to just about six minutes. Slated for operation by late 2026, this four-kilometre rail line is designed to transport up to 10,000 passengers per hour in each direction. This massive reduction in commute time will make Johor Bahru far more accessible for working Singaporeans and frequent cross-border travellers, enhancing Johor’s appeal as a residential and business hub.2. Electric Train Service (ETS):

The ETS offers electrified regional train travel between key Malaysian cities, currently connecting Kuala Lumpur to the northern and southern regions. Progressive upgrades and expansion of ETS services strengthen the rail network, making Johor more accessible from Kuala Lumpur and other important economic centres. This enhanced rail connectivity is significant for property buyers and investors who seek convenience and reduced travel time on intra-Malaysia journeys.3. E-Art (Elevated Autonomous Rapid Transit):

E-ART (Elevated Autonomous Rapid Transit) is a next-generation, trackless mass transit system designed to address urban mobility challenges in rapidly growing Malaysian regions like Iskandar Malaysia and Johor Bahru. Unlike conventional rail or LRT systems, E-ART vehicles run on rubber wheels atop dedicated elevated pathways, guided by advanced sensors and automation technology. This system aims to deliver cost-effective, efficient, and scalable public transportation without the extensive infrastructure costs of rail-based transit.The Johor Property Market Outlook: Current Trends and Projections

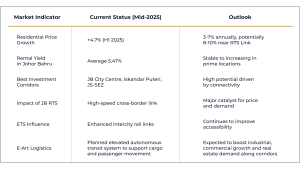

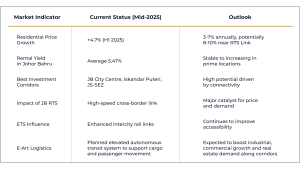

According to recent data, Johor’s property market has seen a substantial upward trajectory in 2025. Residential property prices rose by an impressive 4.7% in the first half of the year, sparked by both local demand and cross-border investor interest resulting from infrastructure improvements. Additionally, transaction volumes increased by over 6.5% in 2024, demonstrating growing confidence in Johor’s real estate. There’s also substantial interest in the Johor-Singapore Special Economic Zone (JS-SEZ), which spans over 3,288 square kilometres and incorporates key growth areas around Iskandar Malaysia and Pengerang. These zones benefit directly from proximity to the JB RTS, ETS lines, and E-Art (Elevated Autonomous Rapid Transit) , creating a powerful synergy driving property price appreciation.Key Observations:

How JB RTS, ETS & E-Art Impact Future Property Price Trends

1. Enhanced Connectivity Equals Higher Demand

The JB RTS drastically improves cross-border travel, making Johor a natural alternative residential market for working professionals in Singapore. This convenience enhances housing demand, especially for condominiums and terraced houses near the RTS station areas. Early data indicates price premiums of up to 10% for properties in these corridors, with forecasts expecting sustained growth of 8% or more annually. Similarly, the ETS continues to facilitate ease of travel between Johor and Kuala Lumpur, bridging the gap between Malaysia’s capital and the southern region. Improved travel infrastructure supports long-term property price appreciation by making Johor more accessible for domestic tourists, investors, and business travellers. Properties near high-quality transit corridors, like E-ART, typically experience increased demand and price appreciation. Research in Malaysia has shown that homes and offices within walking distance (typically within 500m) of mass transit nodes command a premium of up to 5-10% compared to those farther away, due to improved accessibility and reduced commuting times.2. Attraction of Investors and Upsurge in Property Prices

The infrastructure projects combined with the JS-SEZ launch have drawn increased investor confidence. Serviced apartments in Johor Bahru have surged 20.4% in average transaction prices compared to 2024, while landed properties like double-storey terraces saw an 8.6% increase. Enhanced transport and logistics reduce operation costs and raise overall economic vitality, factors that sustain investor optimism and fuel property price appreciation.3. Economic Spillover and Job Creation

The creation of new jobs in the Special Economic Zone and enhanced mobility thanks to JB RTS and ETS contribute to rising household incomes. With improved employment options and income growth, Johor’s housing market is buoyed further as more Malaysians look to invest or upgrade their homes close to these employment hotspots.Market Challenges and Considerations

Despite these positive trends, property buyers and investors should be mindful of certain challenges:- Regulatory and Implementation Delays: Infrastructure projects can encounter construction or regulatory delays affecting timelines.

- Rising Property Costs: While appreciation benefits owners, newcomers may face higher entry prices.

- Affordability Concerns: The surge in property prices near key transit hubs can price out some local homebuyers.

- Market Competition: As Johor’s property market strengthens, competition among domestic and foreign investors increases.

Why Choose the Best Real Estate Agents in Kuala Lumpur for Johor Investments?

Malaysian investors often look to Kuala Lumpur-based experts when considering properties in Johor due to their broader market exposure, deep understanding of national trends, and access to quality listings. The best real estate agents in Kuala Lumpur provide:- Insights into cross-regional property opportunities

- Strategic advice aligned with infrastructure developments

- Comprehensive market analysis blending Kuala Lumpur and Johor trends

- Negotiation skills for optimal deal-making in a competitive environment

FAQs

Q1: When will the JB RTS be fully operational?

The JB RTS is expected to begin operations by December 2026, significantly reducing commute times across the Malaysia-Singapore border.Q2: How much can property prices near RTS Link stations appreciate?

Properties near the RTS Link have the potential to appreciate annually by 8-10%, driven by superior connectivity and demand.Q3: What types of properties benefit most from the ETS expansion?

Residential and commercial properties in cities linked by ETS, including Johor Bahru and Kuala Lumpur, stand to benefit from improved accessibility and increased buyer interest.Q4: How does the E-Art initiative impact Johor’s real estate?

The E-Art initiative boosts Johor’s real estate by improving connectivity, easing traffic congestion, and making properties near transit corridors more attractive to buyers and investors. Enhanced accessibility catalyzes demand and supports higher property values, especially as the E-Art complements major projects like the RTS Link.Q5: Why is it important to work with the best real estate agents in Kuala Lumpur when investing in Johor?

They offer critical market knowledge, access to diverse opportunities, and negotiation expertise essential in a rapidly evolving property market influenced by large-scale infrastructure projects.Conclusion

Johor’s real estate market is poised for robust growth, fueled by transformative infrastructure projects like JB RTS, ETS, and E-Art. These initiatives not only promise improved connectivity but also catalyze significant property price gains and investor interest. For Malaysian buyers and investors aiming to capitalize on these trends, aligning with the best real estate agents in Kuala Lumpur is a strategic move to maximize returns and secure prime assets in Johor’s burgeoning market. For detailed, expert guidance on navigating Johor’s property landscape, visit Gplex and connect with seasoned professionals poised to help you make informed investment decisions.Share this article: