16 Jul 2024

Buy or Rent? A Comprehensive Guide to Making the Right Choice in Malaysia

Making the decision to buy or rent a home is one of the most significant financial choices you will make.

Each option has its unique set of advantages and disadvantages, influenced by various factors such as market conditions, personal financial situations, and long-term goals. In Malaysia, this decision can be particularly nuanced, given the country’s dynamic real estate market. Here, we break down the key factors to help you make an informed choice.

Investment Potential

Buying: One of the primary advantages of buying a property in Malaysia is the potential for long-term investment growth. Historically, property values in Malaysia have appreciated over time. Owning a home means that as property prices increase, so does the value of your investment. This can provide substantial financial returns in the long run, making buying a home a solid investment. Renting: Conversely, renting does not offer the same investment benefits. Rent is considered an expense rather than an investment, as it does not contribute to asset ownership. Over time, the money spent on rent does not build equity or offer returns.Stability vs. Flexibility

Buying: Homeownership provides long-term stability. When you own your home, you have complete control over your living situation. You don’t have to worry about lease renewals or rent increases, and you can plan your life with more certainty. This stability can be particularly appealing for families or individuals looking to settle down. Renting: Renting offers more flexibility, which can be advantageous for those who might need to relocate frequently for work or personal reasons. If your circumstances change, renting allows you to move without the hassle of selling a property. This flexibility can be a significant advantage for younger professionals or those unsure about their long-term plans.Cost Considerations

Buying: One of the biggest hurdles in buying a home is the upfront cost. This includes the down payment, legal fees, and stamp duty, which can be substantial. These initial expenses can be a significant barrier for many potential homeowners. Renting: Renting typically requires lower upfront costs. You generally need to pay a deposit and the first month’s rent, which is more manageable than the costs associated with buying a property. This lower entry cost can make renting an attractive option, particularly for those just starting out or without substantial savings.

Customization and Control

Buying: Homeowners have the freedom to renovate and customize their property to suit their tastes and needs. This level of control can enhance your living experience and potentially increase the property’s value. Renting: Renters have limited ability to make changes to their living space. Most rental agreements restrict significant modifications, which means you might not be able to personalize your home as much as you would like.Exposure to Market Conditions

Buying: Owning a home exposes you to the real estate market’s fluctuations. This means that property values can increase or decrease, impacting your investment. Additionally, you may be affected by interest rate hikes, which can raise your mortgage payments. Renting: Renters are less exposed to market volatility. While rent can increase with lease renewals, renters are not directly affected by property market downturns or interest rate changes. This can provide more financial predictability and security in uncertain economic times.Monthly Payments

Buying: Fixed monthly mortgage payments can offer predictability, allowing homeowners to plan their finances with more certainty. Once you lock in a mortgage rate, your payments remain stable, which can be a significant advantage in budgeting. Renting: Rent payments, on the other hand, can increase with each lease renewal. This lack of predictability can make long-term financial planning more challenging for renters.

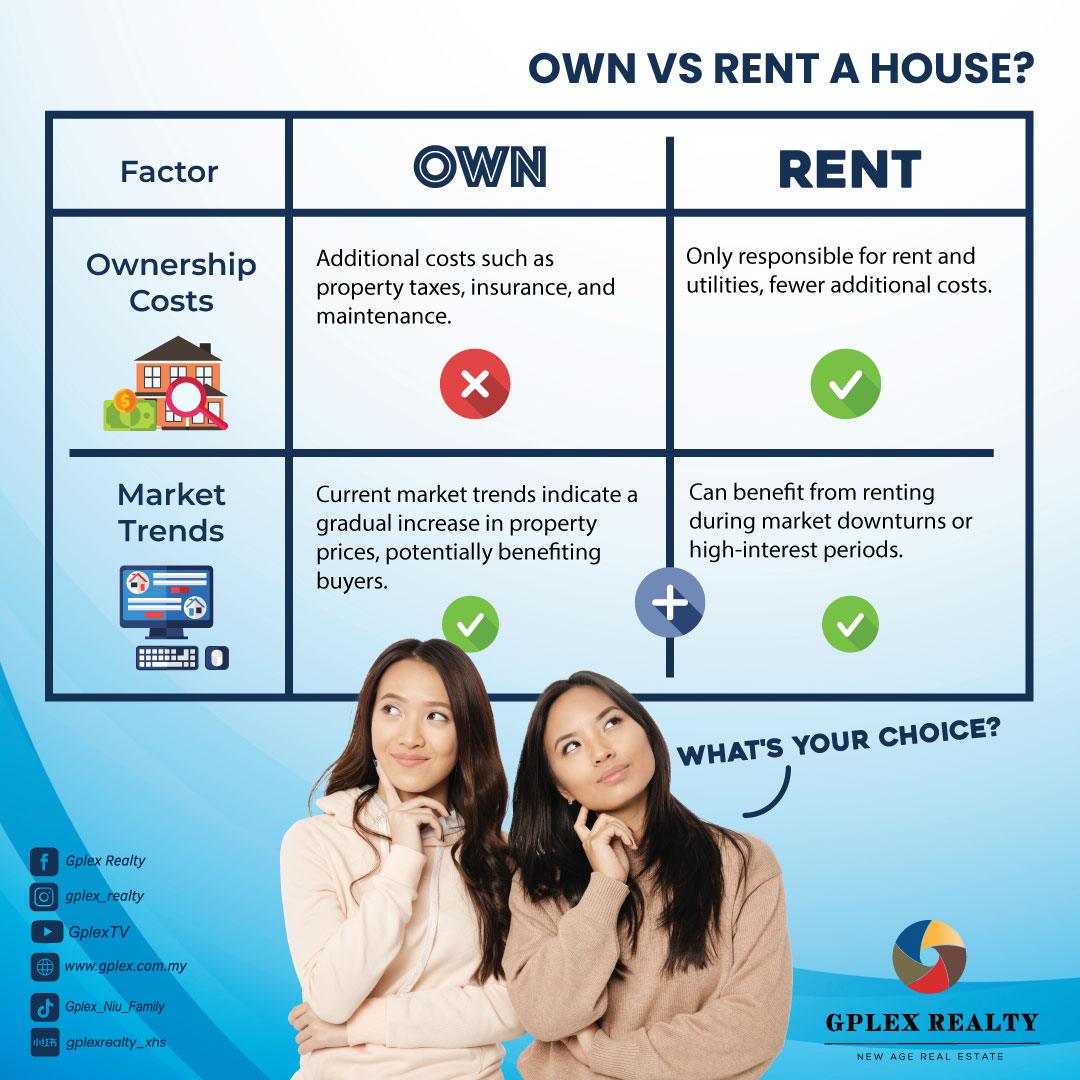

Ownership Costs

Buying: Homeownership comes with additional costs beyond the mortgage payments. Property taxes, insurance, and maintenance are ongoing expenses that homeowners need to budget for. These costs can add up and should be considered when evaluating the true cost of buying a home. Renting: Renters are typically only responsible for their rent and utilities, with fewer additional costs. Maintenance and repairs are usually the landlord’s responsibility, which can save renters money and hassle.Market Trends

Buying: Current market trends in Malaysia indicate a gradual increase in property prices, potentially benefiting buyers. This trend suggests that investing in property now could lead to significant appreciation in value over time, making buying an attractive option for those looking to build wealth. Renting: Renters can benefit during market downturns or high-interest periods. When property prices are stagnant or falling, or when interest rates are high, renting can be a more financially prudent choice. It allows individuals to avoid the risks associated with property market fluctuations and save on higher mortgage costs.Conclusion

The decision to buy or rent a home in Malaysia depends on various factors, including your financial situation, lifestyle, and long-term goals. Buying a home offers stability, potential investment returns, and the freedom to customize your living space. However, it also comes with significant upfront costs and exposure to market risks. Renting provides flexibility, lower initial expenses, and fewer responsibilities, but it does not offer the same investment potential or long-term stability. Carefully weigh these factors to determine which option aligns best with your personal circumstances and future aspirations. Whether you choose to buy or rent, making an informed decision will help you achieve your financial and lifestyle goals.Share this article: